How to Create a Budget That Works for You (Even on a Small Income)

Creating a budget can feel overwhelming, especially when you’re living on a small income.

But here’s the good news: a budget isn’t about restriction; it’s about taking control of your money so you can achieve your goals.

Whether you’re saving for an emergency fund, paying off debt, or simply trying to make ends meet, this beginner-friendly guide will help you create a budget that works for you—and stick to it!

Save this post for future reference!

Don’t forget to pin this for later!

Step 1: Understand Your Income and Expenses

Start by getting clear on your financial situation. Here’s how:

- Calculate Your Income

Write down all sources of income, including your job, side hustles, or any other regular payments you receive. If your income varies, use an average amount based on the past three months. - Track Your Expenses

Review your spending over the last month. Categorize your expenses into fixed (e.g., rent, utilities) and variable costs (e.g., groceries, entertainment). Tools like budgeting apps or a simple spreadsheet can help streamline this process.

Get my free expense trackker

When you join our newsletter

your embed code hereStep 2: Set Financial Goals

What do you want to achieve with your budget? Clear goals give you a reason to stick to your plan. Examples include:

- Building a $1,000 emergency fund

- Paying off credit card debt

- Saving for a vacation or a big purchase

Write down your goals and prioritize them based on urgency and importance.

Finance Goals for Your 20s: 9 Money Moves to Make | Truist

Step 3: Choose a Budgeting Method

Pick a budgeting method that aligns with your lifestyle. Here are a few popular options:

- 50/30/20 Rule

Allocate your income as follows:- 50% for needs (rent, groceries, utilities)

- 30% for wants (entertainment, dining out)

- 20% for savings or debt repayment

- Zero-Based Budgeting

Assign every dollar of your income to a specific purpose. This method works well if you want to track every penny. - Envelope System

Set aside cash for each category in labeled envelopes. Once the envelope is empty, you stop spending in that category until the next budget cycle.

Step 4: Create Your Budget

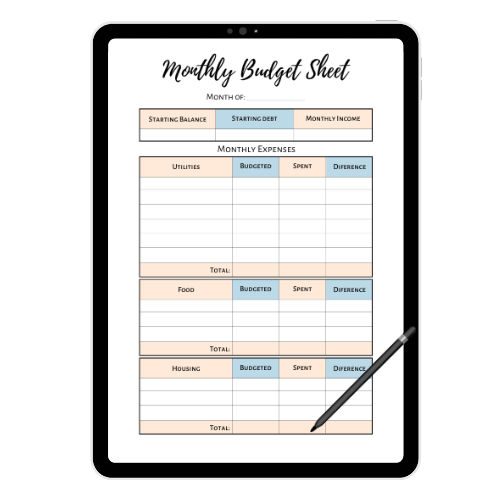

Now it’s time to build your budget. Use the information you gathered to allocate funds to each category.

Start with necessities like housing, utilities, and food. Then, allocate money for savings, debt repayment, and discretionary spending.

Don’t forget to include a small “fun money” category—you’re more likely to stick to your budget if it feels balanced.

Step 5: Find Ways to Cut Costs

If your expenses exceed your income, look for areas to cut back. Here are some ideas:

- Groceries: Plan meals, buy generic brands, and shop sales.

- Subscriptions: Cancel services you rarely use.

- Utilities: Lower your bills by conserving energy.

- Entertainment: Explore free or low-cost activities in your area.

Save $250 On Groceries By Doing This

Step 6: Automate and Track Your Progress

- Automate Savings and Bills

Set up automatic transfers for savings and payments. This ensures your priorities are funded without the temptation to overspend. - Track Spending Weekly

Use a budgeting app or journal to review your spending and adjust as needed. This keeps you accountable and helps you identify problem areas early.

Step 7: Adjust as Needed

Life happens, and your budget should be flexible enough to adapt.

If unexpected expenses arise, revisit your plan and make adjustments. The key is to stay consistent and committed to your financial goals.

Final Thoughts

Budgeting on a small income is possible—it just takes planning, discipline, and a clear sense of purpose. Remember, every small step you take brings you closer to financial stability and peace of mind. Start today, and celebrate your progress along the way!

Do you have a budgeting tip that works wonders for you?

Share it in the comments below!

Let’s inspire each other to reach our financial goals.

Don’t forget to pin this for later!